The war in Ukraine has propelled office occupier considerations on energy costs to the top of the business agenda. Darren Clarke and Stephen Clayton, within LSH’s respective property management and ESG teams, reflect on how we are helping our clients to mitigate costs and take action on energy consumption.

Download the Regional Office Market Report 2022 here

BUSINESSES REELING FROM ENERGY PRICE HIKES

On the heels of the pandemic, businesses up and down the country are now facing the challenges of a full-blown energy crisis. Energy is a complex and dynamic market with prices influenced by a variety factors. In this instance, geopolitics form the primary reason - Russia’s invasion of Ukraine suddenly exposed the vulnerabilities of European energy security, with a halving of gas supplies into Europe pushing volatility and pricing to unprecedented levels. At the summer peak, the scramble to fill gas storages across continental Europe for the coming winter saw prices hit an all-time high of 830p/therm.

Almost overnight, the crisis has transformed office occupiers’ considerations around energy costs and usage. Until recently, these considerations were typically ethical in nature, involving efforts to mitigate carbon emissions and demonstrate commitment to ESG goals. Now, with occupiers seeing up to a fivefold increase in their energy bills, the crisis poses a direct impact to the bottom line. It is also stoking inflation as many businesses have to pass these extra costs to their customers in order to remain profitable.

The issue was serious enough to have prompted major government intervention through the Energy Bill Relief scheme, initially announced in September and subsequently modified. While the package of support will help, it only shields businesses from the very worst of the volatility. According to LSH’s recent Total Office Cost Survey (TOCS), even with the relief applied, energy costs now account for between 8% to 15% of total occupancy costs depending on the building, compared with a range of only 2% to 5% prior to the pandemic in 2019.

NEW CONTRACTS

In the wake of the crisis, suppliers are now focusing heavily on credit ratings as their customers struggle to pay bills. Limited risk appetite means suppliers are reluctant to issue long term contracts beyond a year or even refuse to offer contracts and renewals without sizeable security deposits or making contracts conditional upon direct debit arrangements.

Some suppliers have even exited the commercial market altogether, lowering the amount of choice business users have in the market. The managing agent market has tightened and availability of contracts into this key commercial sector have reduced with significant restriction being placed on availability through the second half of 2022. This has resulted in managing agents having to consider alternative procurement strategies for client energy contracts, with suppliers seeking to transfer risk as a core consideration of these products.

TIMING IS EVERYTHING

The renewal date of contracts has dictated the position in which businesses find themselves when procuring energy through 2022. Historically, a large proportion of energy contract renewal dates fell on 1 October as a consequence of the date on which the sector was privatised. LSH’s client group contract was fixed over the past two years with end users benefiting from competitive prices at a time of rising prices in the market. Unfortunately, having initially benefitted from the decision to fix for a longer term in 2020, as with many other businesses and managing agents, contract renewal came at a difficult and chaotic time for the market.

The options available have been extremely limited with contractual concessions outweighing the benefits associated with a fixed price/term contract. Certainty is a clear desire as is mitigation of risk, but at what price? And how does this impact on occupiers and investors, the latter of whom could be carrying all-inclusive service charge caps, conceived at a time prior to the energy crisis? Similarly, the financial impact on occupiers and the need to meet increasing energy recharges could impact the occupier covenant strength and hence value of an asset.

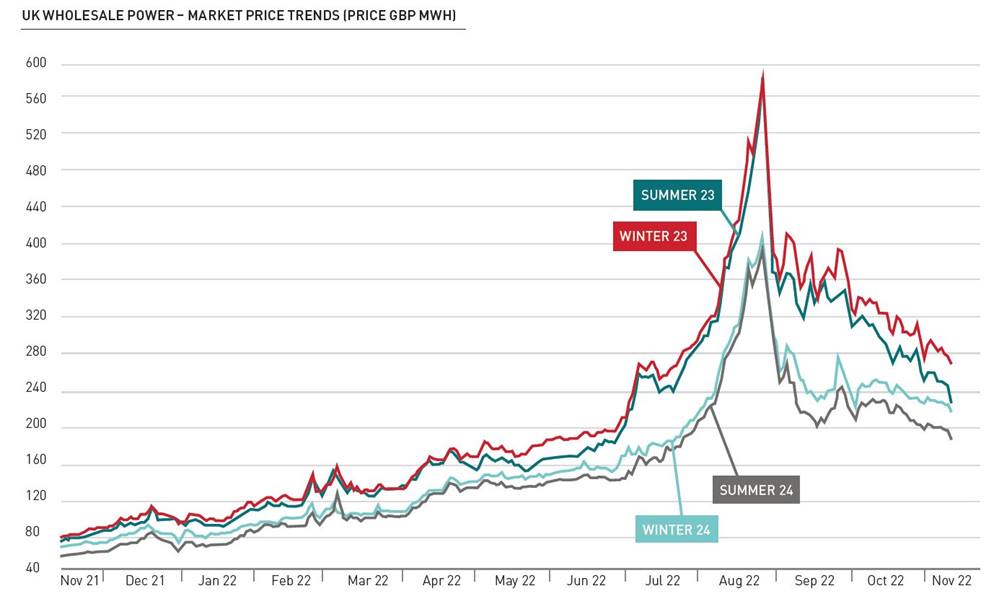

PRICING

Given the lack of availability of fixed term contracts through the summer months and with an impending renewal date of 1 October, our energy governance team, through dialogue with our clients and sector specialist advisors, opted for a flexible forward buying procurement framework to mitigate price increases.

The wholesale rate secured this winter on the new flex arrangement is now 100% committed for the period of the business Energy Bill Relief scheme with a forward purchasing strategy actively in place for Summer 2023 and beyond. This strategy compares favourably with half-hourly deemed rates that have been seen through October and November of anything up to 130p/kWh and up to 110p/kWh for fixed rate options taken in late September/early October 2022 on 6 or 12 month contracts. This compares with our LSH group client’s 2020 fixed rate of approximately 14p per unit for electricity. The same considerations apply for gas in terms of mitigation of risk and exposure to significantly increased costs.

CURRENT SCOPE OF GOVERNMENT SUPPORT

Under the new Chancellor, the Government recently announced some changes to the original basis of the business Energy Bill Relief scheme. The maximum discount for those on a default or variable tariff will be 34.5p/kWh for electricity and 9.1p/kWh for gas if prices are secured above the threshold of £211/MWH for electricity and £75/MWH for gas. For fixed tariffs the discount is variable based on the wholesale price on the date the contract was secured. The relief scheme is running until April 2023 with the government reviewing if further ongoing support is required or affordable beyond this date.

FLEXING YOUR PROCUREMENT

In addition to cost issues, this winter may see grid disruption across the country, should the UK suppliers fail to secure sufficient supply to meet demand. Lambert Smith Hampton has worked up contingency measures to mitigate the worst effects of possible power disruption, should the worst happen.

KEY RECOMMENDATIONS

Our mantra is that the cheapest kWh is the one you do not use. In addition to energy procurement matters, Lambert Smith Hampton’s expert team of property managers actively engages with landlords and occupiers to help reduce energy use and mitigate risks.

Our key recommendations are as follows:

- MONITORING – Implement energy monitoring for out of hours usage and demand management to further refine BMS, HVAC plant settings and timings.

- EFFECTIVE DEAD BANDING - Ensure temperature setpoints have enough dead banding so heating and cooling are not conflicting.

- ENGAGE - Engage with occupiers and appoint an energy champion to manage demised energy use, if controls are within their demise.

- RESILIENCE TESTING - testing of building resiliency measures by ensuring generators are operational and stockpiling generator fuel as appropriate and where the opportunity exists.

- EXPLORING INVESTMENT - provide proposals to bring forward CAPEX and OPEX energy savings projects, including both upgrades to plant and installation of on-site renewables, especially now that payback times are now 3-5 times quicker.

- LOAD SHIFT – establish ways to remove as much consumption as possible away from peak times, as this is the most likely time where grid instability will happen.

- FORECASTING DEMAND - Close monitoring and forecasting of forward energy requirements and any known variables that are likely to alter levels of consumption.

- PARTNERING – LSH is also introducing more extreme energy savings measures with our partners at 4D monitoring, FMs and M&E consultants as cost savings are now more incentivised than ever.

We are closely reviewing developments in the energy markets to provide long term value for money to clients, whether investor or occupier.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email