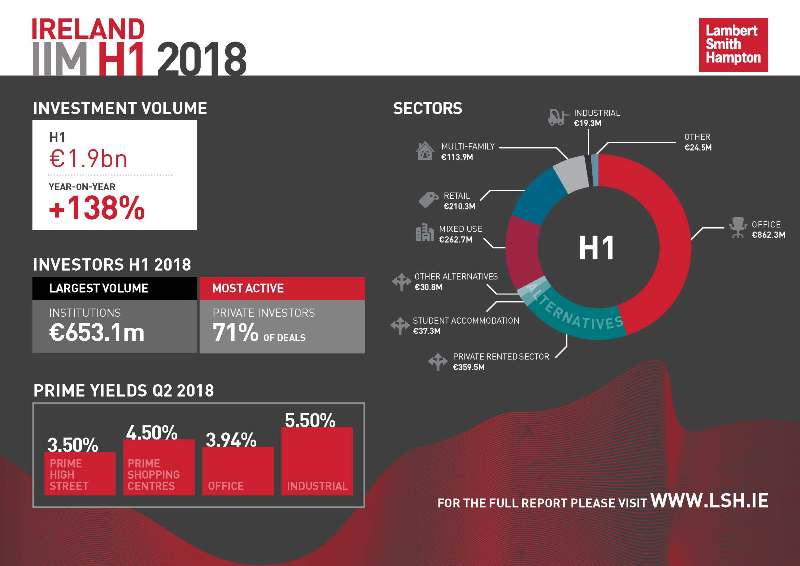

The Ireland Investment Market Report H1 2018 found that while overall activity has been healthy, it was a very mixed pattern across the sectors.

Continuing its dominance as the most invested in sector, H1 saw €862.3m of investment into the office sector. Ninety percent of office volume was invested in Dublin, with two-thirds in the city centre area.

Headline deals in the office sector included the €175m Eir Headquarters at Heuston South Quarter (NIY 4.87%), the €164m Dublin Landings in the Docklands (NIY 3.94%) and the €101m Beckett Building on East Road (NIY 4.13%).

The alternatives sector, which comprises of investments in assets such as student accommodation, leisure, healthcare, hotels and car parks, continues to grow rapidly benefitting from a structural shift in investor behaviour. In H1 investment in alternative assets stood at €403.1m, accounting for 21% of investment volume. Most notably amongst the categories of alternative assets, a total of €359.5m was invested in the private rented sector.

Two €100m+ headline transactions completed, specifically the €101m 6 Hanover Quay, Dublin 2 (NIY 4.00%) purchased by Carysfort Capital and the €100m Fernbank, Dublin 14 (NIY 6.00%) purchased by Irish Life Investment Managers.

At €210.3m retail investment accounted for only 11% of total transaction volume, the smallest proportion since H2 2013. Retail investment was boosted by Deutsche Bank’s €147.7m acquisition of Westend Retail Park, Blanchardstown (NIY 5.30%).

Paddy Brennan, head of capital markets in Ireland at LSH, said:

“This year to date, there has been significant overseas investment in Ireland with a number of the highest value assets purchased by investors from the USA, Korea and Hong Kong. The attractiveness of Ireland, and more specifically Dublin office investments, shows little sign of slowing.

He added: “Strong investor sentiment remains in the office sector and the shift to alternative assets continues. The outlook for the Irish commercial property market for the remainder of 2018 is positive. Despite the post-deleveraging environment and the October 2017 rise in non-residential stamp duty, H1 activity is only 17% lower than the 2017 annual total, spurred on by an increase in supply of large office assets, the strong office occupier market and the opportunities this presents for investors. We forecast that the 2018 annual total will reach €3bn.”

Click here to download the report

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email