Download the Investment Transactions Northern Ireland H1 2025 report here

Our Investment Transactions Northern Ireland report highlights some interesting trends in the market at the halfway point of 2025.

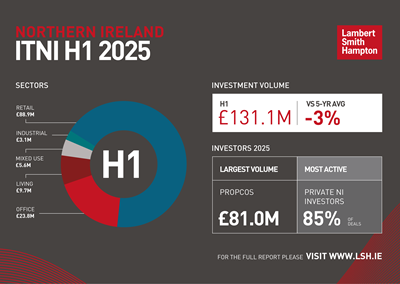

Investment volume hit £131.1m in the first half of 2025, 3% below the five-year half year average. After a subdued Q1, the research shows investment volume in Q2 picked up substantially and exceeded £100m for the first quarter since 2023. The value of deals has already surpassed the £127.1m recorded in the whole of 2024.

What’s behind this jump? It’s all about shopping centres. At £88.9m, H1 retail volume stood 34% above the five-year half year average. Deal volume has been driven by retail activity, which in Q2 included the Herbert Group’s £58.8m acquisition of Abbeycentre from NewRiver - the largest retail transaction since 2017.

It appears that after a weak 2024, investors are ready to deploy capital for good quality assets with strong fundamentals, which are fairly priced. But the outlook is mixed for the second half of this year, with geopolitical uncertainty affecting investor sentiment and limited stock available to fuel activity.

Claire Shaw, Senior Research Analyst at Lambert Smith Hampton, said: After the weak performance of 2024, H1 saw a welcome and marked improvement in both investment volume and market activity. While Q1 volume was subdued, there has been a clear demonstration of the readiness of investors to deploy capital even for those larger lot size purchases, for good quality assets with strong fundamentals, which are fairly priced.”

Jonathan Martin, Director at Lambert Smith Hampton, said: “Off market deals are occurring more regularly as vendors discreetly test the appetite for an asset with a select group of well capitalised investors, and this has proven to be a successful strategy when seeking to align the aspirations of both purchaser and vendor. The retail comeback continues and activity is underpinning volume in a way that would have seemed unlikely five years ago. Investors are increasingly returning to this core sector across all pricing levels. That said, supply will continue to be the key challenge in H2 with limited stock to fuel activity.”

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email