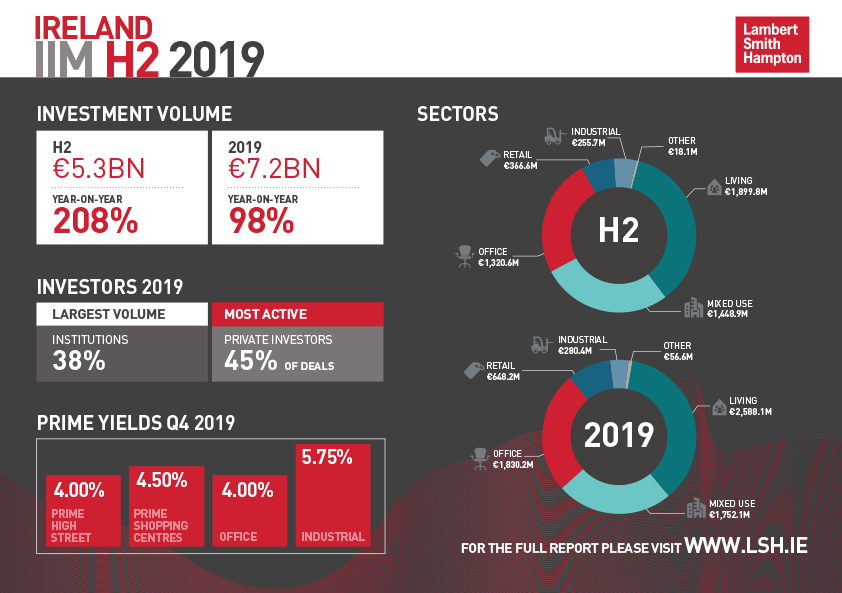

Investment volume in 2019 reached a record-breaking €7.2bn, almost double 2018 and 68% above the five-year average according to our new research published today.

DOWNLOAD THE FULL REPORT

Volume was boosted by €100m+ transactions and an outstanding final quarter which included the largest single investment deal, the €1.34 bn sale of Green REIT’s nationwide office and logistics portfolio to Henderson Park Capital.

Living sector transactions, dominated by PRS and multi-family units in Dublin, totalled €2.6bn and accounted for over a third of volume. There were a number of large portfolio deals including XVI Portfolio purchased by IRES Reit for €285.0m and the Vert Platform purchased by Tristan Capital Partners and SW3 Capital for €216.1m.

Investors continued to show confidence in office investments with volume of €1.8bn, the highest annual total on record. 2019 deals included the purchase of the Cedar Portfolio, a portfolio of landmark offices located in Dublin’s central business district, by Blackstone for €530.0m and the newly built 5 Hanover Quay by Union Investment for €197.0m.

Industrial volume reached a new high of €280.4m which included the sale of Ireland’s largest building, a Tesco distribution centre in Donabate, sold to KTB Investments & Securities and KTB Asset Management for €160.0m.

Keith Shiells, Regional Director Ireland at Lambert Smith Hampton, said: “2019 exceeded all expectations for the Irish commercial property market which has been going from strength to strength in recent years. The strength of investor appetite is not expected to wain and it is forecast that 2020 will be another strong year, but annual volume will be more in keeping with the five-year average of around €4.0bn. Office transactions are likely to dominate in 2020, primarily due to lack of supply of PRS assets.”

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email