Enquiries on the rise

Take up in Q3 recovers

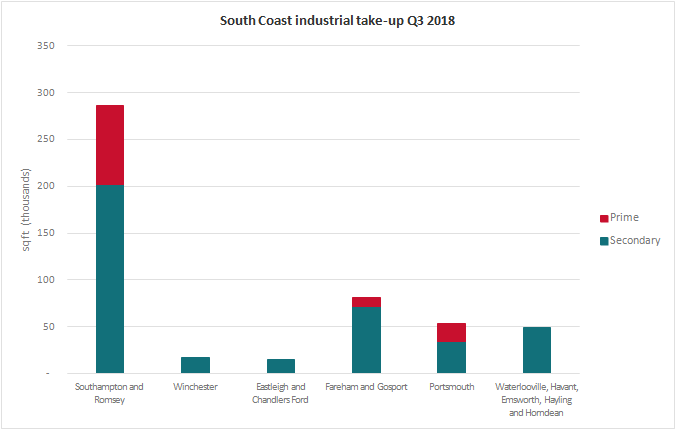

| Q3 2018 (sq ft) | Q2 2018 (sq ft) | % change | % change Year on Year | |

| Total take up | 501,071 | 241,655 | 107.35% | -0.65% |

| Prime take up | 113,815 | 18,778 | 506.11% | -50.10% |

| Secondary take up | 387,256 | 222,877 | 73.75% | 40.17% |

Significant occupational transactions

| Property | Size | Landlord | Tenant | Terms | Rent/Price (per sq ft) |

| Unit 42 Oriana Way, Nursling | 62,003 sq ft | CBREGi | Gregory Distribution | 10 year lease | £7.00 |

| Unit 3 South Central, Southampton | 48,080 sq ft | La Salle | John Lewis Partnership | 15 year lease | £9.00 |

| Industrial unit at Parklands Business Park | 27,600 sq ft | Higham Furniture | Freehold Sale | ||

| Unit D2 Hamilton Business Park | 24,760 sq ft | Hargreaves | DSV Air & Sea Limited | 5 year lease | £9.75 |

| Unit 4 Mauretania Road, Nursling | 16,447 sq ft | CBREGi | Union Mart Ltd | 10 year lease | £7.50 |

| Unit 7 Merlin Park | 12,270 sq ft | BA Pension Fund | Scott Cables | 15 year lease | Confidential |

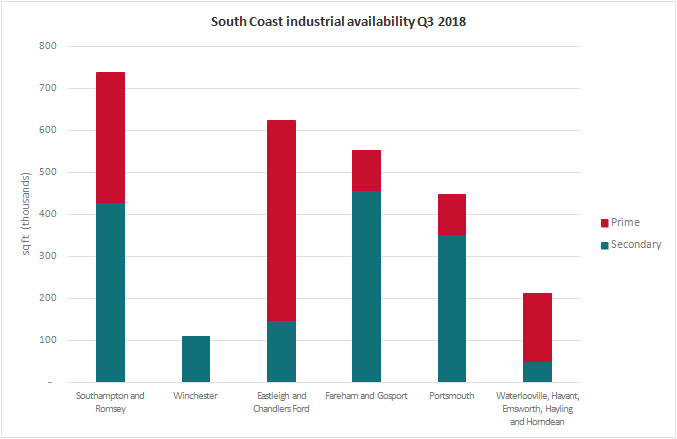

Availability marginally increases

Further grade A stock has entered the South Coast market this quarter, although this is at a slower rate than we have witnessed in the last 2 quarters. These included Plot 3B Dunsbury Park totalling 38,000 sq ft, Phase 2 at Daedalus Park comprising 14,141 sq ft and a three-unit development at Mortimers Industrial Estate of 6,305 sq ft.

Availability of secondary stock has marginally increased when compared to last quarter with large units such as 36 Brunel Way, 9 Test Valley Business Park now on the market, with the latter already under offer. However year on year this still represents a decrease of circa 200,000 sq ft.

The vital statistics have been summarised below:

| Q3 2018 (sq ft) | Q2 2018 (sq ft) | % change | % change Year on Year | |

| Total stock | 2,676,274 | 2,616,679 | 2.28% | 21.64 |

| Prime stock | 1,134,210 | 1,138,217 | -0.35% | 150.53 |

| Secondary stock | 1,542,064 | 1,478,462 | 4.3% | -11.75% |

Investment Market Review

A number of Key transactions were concluded in Q3 which not only comprised Lineside Industrial Estate surpassing its quoting level of £19.17m (see Q2 Pulse for information) but included:

Hounsdown, Totton (rebranded to Optima 125): The property which comprised a vacant 125,000 sq ft refurbished distribution unit was sold to TH Real Estate for £18.85m.

Access Point: Unit 1 was sold on a 999 year lease and Unit 2 was let to Formaplex with a term certain of 8.36 years generating a current passing rent of £337,500. The freehold interest was acquired by BMO for £6,850,000 reflecting a NIY of 4.62%

Units 10-15 Petersfield Business Park: This Freehold multi-let trade counter estate with an AWULT to breaks of 7.30 years and generating a current passing rent of £203,592 was acquired for £3.80m reflecting a NIY of 4.99%. Quoting was £3.1m and 6.17% NIY.

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email