The flight to quality clearly continued in Q2. 80% of the 3.2m sq ft of transactions in the quarter were of grade A or refurbished space. Occupiers are facing a dwindling labour pool and are aware that to recruit talented staff, or to encourage existing staff to return to the office, they need to offer an excellent workplace experience.

A high proportion of deal activity has come from large occupiers pre-letting space, and four deals alone totalled 700,000 sq ft. This will help those occupiers to take early advantage of occupying a new space, using the anticipation of an enhanced workspace as a recruitment tool.

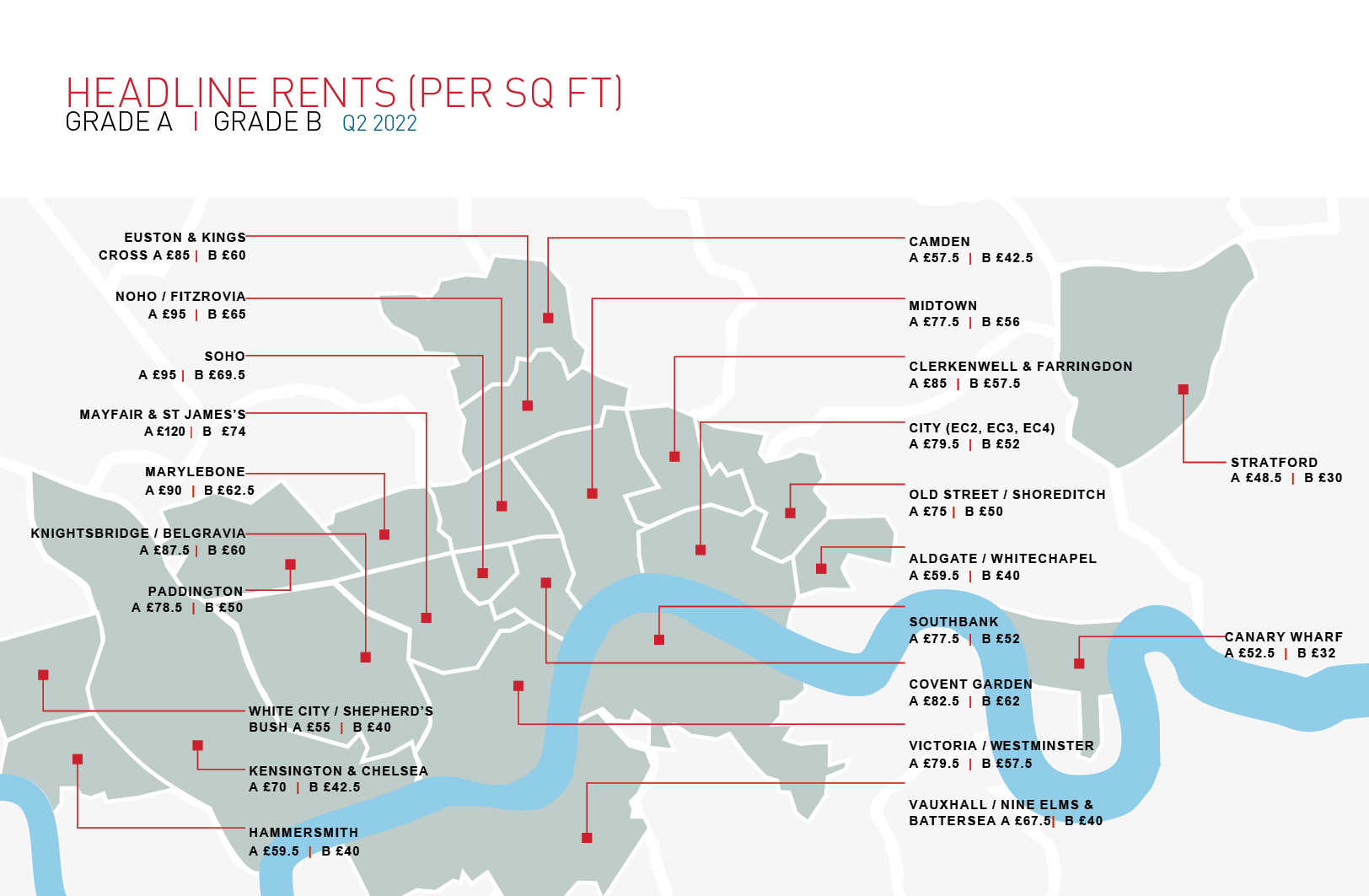

These occupiers might also be recognising that a lack of grade A supply is on the horizon. This can be seen in the rental levels achieved across London, as landlords are in a position to set rental tones. Certain districts are seeing an increase, such as Mayfair, which now commands a headline rent of £120/sf, up from £110 in the same period last year. Pockets of the City now command £75/sf, up from £69/sf last year).

Click picture to expand

The grade A/grade B divide

The strong uptake of grade A space is a contrast to slow uptake of grey or second-hand space. Older buildings that do not offer the level of amenities or factors occupiers are seeking, such as cycle facilities, outdoor space or a high green rating, are not being taken up. This has become a hard market, that many property owners and tenants looking to dispose of leases will be feeling.

However, the polarisation between grade A and grade B offers an opportunity for investors willing to reposition old stock. It is quicker to regenerate an existing building and bring it back to market than it is to construct a new property.

This also offers the potential to score highly in terms of sustainability, a factor that occupiers will consider. There is an additional green imperative just around the corner: from April 2023, all commercial buildings must have an EPC of E or higher, whether they are subject to a new or an existing lease. The government is likely to impose further that all commercial buildings will need to achieve an EPC rating of at least B by 2030.

Rates could rise

It will be interesting to see if the high level of transactions for grade A space experienced in Q2 continues in the current economic climate. Inflation has topped 10% and the energy crisis is set to have a significant impact in the autumn and winter, if it hasn’t already.

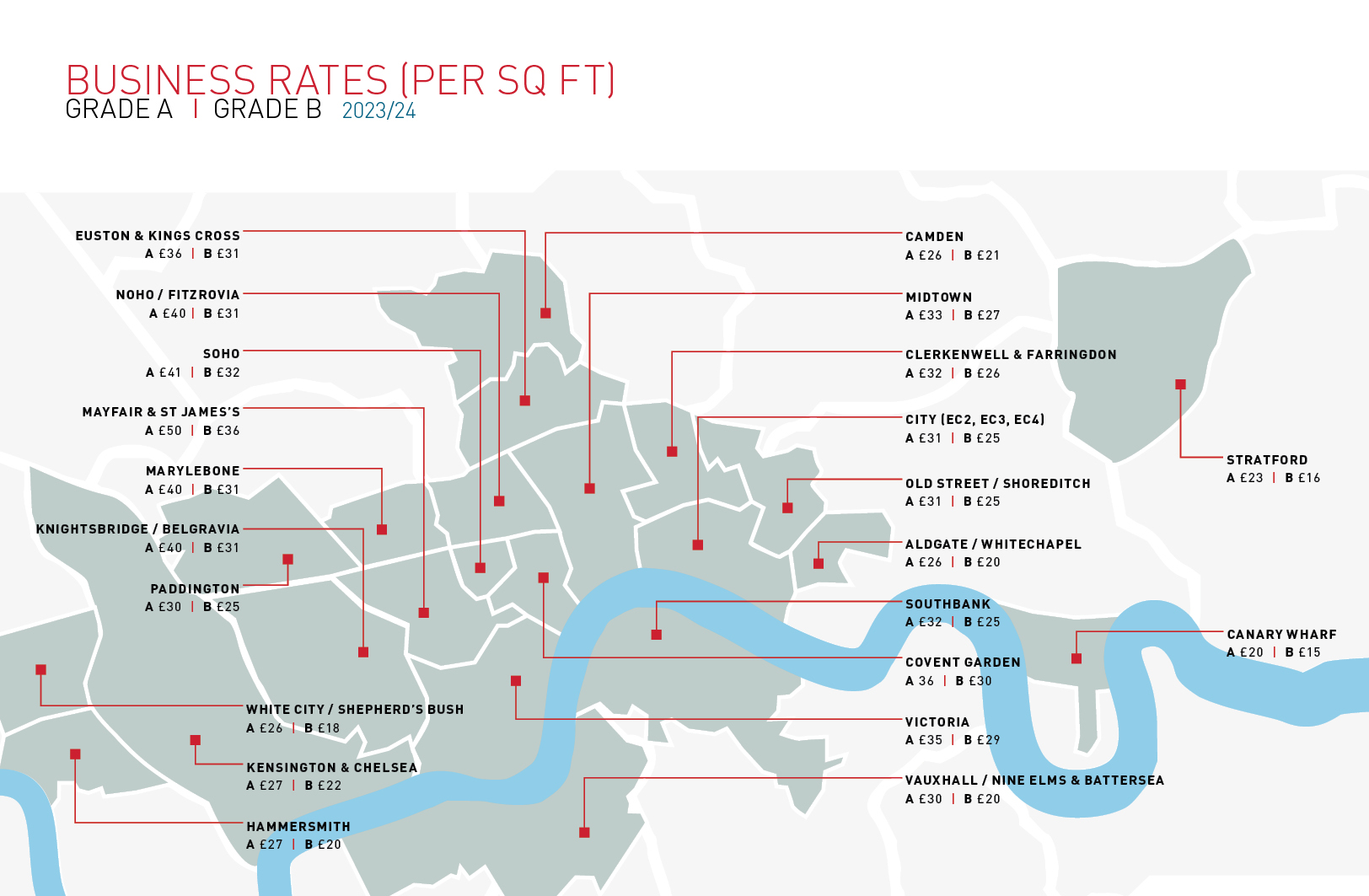

On top of this backdrop is a potential rise in business rates. The next rates revaluation takes place on 1 April 2023 when all commercial properties in the UK will be reassessed for rates based on 1 April 2021 rental values.

Despite the fact the country was in lockdown on the valuation date, LSH’s data suggests this will result in significant increases in rates payable for offices in certain parts of London. On average the liability for grade A offices will increase by 24%, and by 22% for grade B offices. The highest increase will be in Vauxhall, Nine Elms and Battersea. The only area predicted to experience a decrease in rates is Mayfair and St James’s.

The Government is yet to announce how rates increases will be implemented, but occupiers considering a relocation will need to keep the impact of the revaluation in mind.

Click picture to expand

Consider waiting

Of course, activity in Q2 could still be considered a result of the delays that many businesses put on making occupancy decisions due to the pandemic. Some businesses must move this year or next.

However, given increasing rents and the potential for rates increases in 2023, waiting might be preferable, if it is an option. There is no doubt that high debt and high utility costs will impact UK productivity, possibly even by the end of the year, which will create an even more turbulent business environment.

It is important for occupiers to receive professional advice early, to help them on the journey to finding a new workplace. An advisor will work through points such as space requirements and potential rates increases, all factors that will make a huge difference to the long-term success of a relocation.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email