The Northern Powerhouse is home to a diverse array of talent and skills, with each of its urban centres offering expertise and unique strengths. To assist prospective occupiers and investors to the region, we have assessed the key employment hotspots and the outlook for growth.

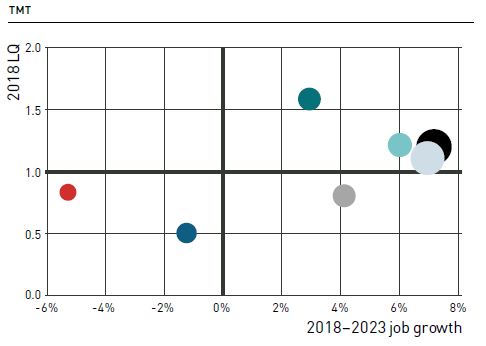

TECH, MEDIA AND TELECOMMUNICATIONS (TMT)

The Northern Powerhouse has experienced substantial growth in the TMT sector, with the number of jobs in the key urban centres collectively increasing 23% over the last five years since 2013. It is also forecast to increase by a further 4,200 from 2018 to 2023.

Renowned as a TMT hub, Salford has the region’s strongest concentration of TMT sector jobs, standing 59% above the national average. The BBC’s major relocation to Salford Quays in 2014 has proved a catalyst, stimulating further growth. Meanwhile, Newcastle has seen the fastest job growth within the sector, increasing 59% over the last five years.

At 25,808, Leeds boasts the highest number of TMT sector jobs outside London and is forecast to increase by 7.2% over the next five years – the strongest increase of the markets.

Channel 4’s recent decision to locate its new national headquarters in the city is a major coup for the city and testimony to its growing reputation as a hub for the media industry.

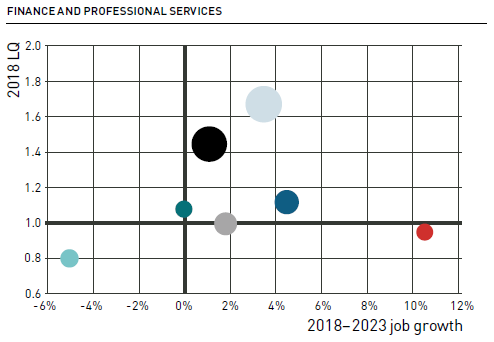

FINANCE AND PROFESSIONAL SERVICES

Manchester is the undisputed capital of finance and professional services in the Northern Powerhouse, with employment in the sector standing 67% above the national average. Key developments such as the financial and professional services district, Spinningfields, have contributed to the growth, home to Barclays, PWC, DWF and RBS to name a few.

Leeds follows closely behind with employment 45% above the national average, and it is well known for its legal services cluster. Liverpool also boasts a high number of jobs within the finance and professional services sector, and is one of the UK’s leading financial centres with particular strengths in wealth management.

While Sheffield’s employment in finance and professional services is in line with the UK average, it has recorded the fastest employment growth of the key locations in the region, expanding 19% over the past five years. Meanwhile, Warrington has a below average concentration of jobs within the sector but is forecast to see considerable growth of 10.4% from 2018 to 2023.

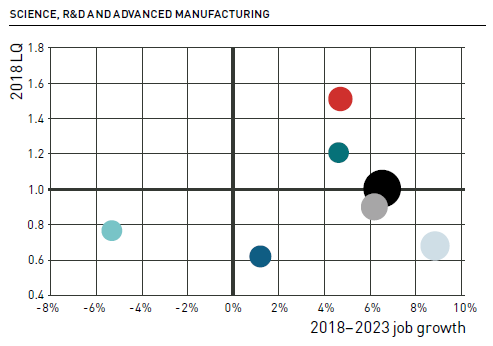

SCIENCE, R&D AND ADVANCED MANUFACTURING

With a proud industrial history, the Northern Powerhouse today is at the forefront of innovation and boasts some of the UK’s largest manufacturing and advanced engineering clusters. The region is home to 11 of the UK’s top 50 universities, developing skills and world-leading research.

Renowned as the UK’s capital of the nuclear industry, Warrington has a high concentration of jobs within the science, R&D and advanced manufacturing sector – 52% above the national average.

While Sheffield’s employment in this area stands slightly below average, the wider South Yorkshire region is home to the Advanced Manufacturing Park and is gaining a growing global reputation as a centre for innovation. McLaren Automotive has opened a £50m technology centre this year, which when fully operational will employ circa 200 people.

HOW TO READ THE GRAPHS

- The graphs show the relevant industry (jobs) for the key locations, colour coded as per the key.

- The size of the dot represents the number of jobs within the relevant sector.

- The position of the location dots on the graph are dictated by the LQ (Location Quotient) profile of the relevant location’s occupation set.

- The vertical axis reflects the location quotient which is the density of the sector’s jobs in the market, with the value of 1 representing the average UK.

- The horizontal axis reflects forecasted growth in the number of jobs within the sector from 2018 to 2023.

- In summary, larger population dots in top right part of the graph are strongest locations and vice versa, smaller population dots in bottom left part of graph are the weakest.

KEY

This article first featured in our Northern Powerhouse Office Market Report 2018/19. Click here to request a copy.

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email