After a weak Q4, greater clarity stemming from the election result is set to unleash strong investment activity across the South East office market at the start of 2020.

Amid a very quiet final quarter for the South East Office investment market, Q4 volume was given some respectability by a flurry of big ticket deals, all of which concluded in the final weeks of the year. Taken together, December’s three major deals accounted for almost half of Q4’s £640m total volume.

The largest deal was a portfolio transaction, namely Elite Partners Capital’s £94.6m purchase of the Bruton Portfolio (NIY 4.75%) with December’s other major deals comprising Middle Eastern Private investor's £86m purchase of the ASOS headquarters building at Leavesden Park, Watford (NIY 5.25%) and Brockton Everlast’s £80m acquisition of Seacourt Tower, Oxford from the BA Pension Fund (NIY 4.84%).

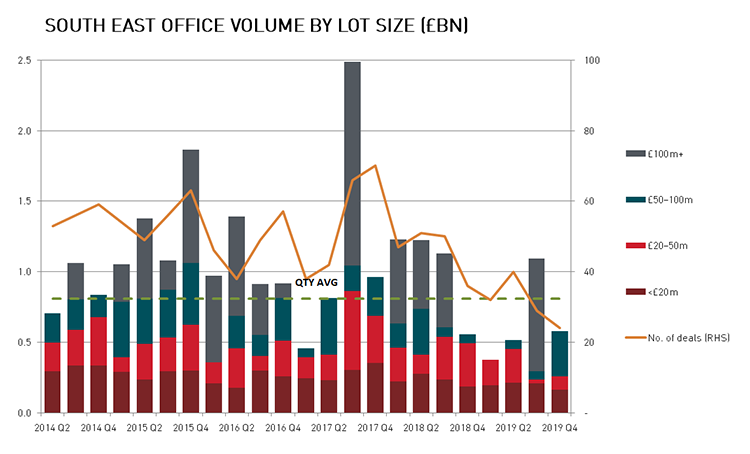

In spite of the late rally, Q4 volume was nonetheless 21% below the 10-year quarterly average, while the number of deals, standing at only 28 in total, was the lowest seen in a single quarter for seven years.

As with other parts of the UK CRE market, Q4’s paucity of activity clearly reflected a lack of quality stock alongside high levels of apathy among potential buyers, linked to Brexit and political uncertainty in the lead up to December’s general election.

Despite positive underlying fundamentals in the South East office occupier market, the quiet final quarter also capped an unremarkable year for volumes. Total volume for 2019 amounted to £2.6bn, the lowest annual total since 2012.

While twists and turns over Brexit lie ahead in 2020, December’s resounding election result has delivered much greater clarity to the market environment. With well over £500m of stock currently under offer, Q1 volume is expected to rebound considerably from Q4’s paltry level, while the election result is set to bring more serious buyer interest over the coming weeks.

Charlie Lake, Capital Markets Director, at LSH commented: “Disappointing as Q4 was, the weak activity we saw was entirely understandable as levels of uncertainty really came to a head towards the end of the year. But now I expect the market to hit the ground running in 2020. The election result and weight of capital in the market will convert latent demand into deals, and I expect volume to be in the order of £800m in Q1, a huge improvement on Q4 and ahead of the 10 year average. “The South East office market is well placed to attract opportunity seeking investors. Tight levels of grade A supply continue to support rental growth prospects in a host of markets across the South East, and improving clarity should encourage more investors to consider asset management angles. Those investors that can identify the right buildings in the right markets, while heeding structural change in occupier demand, stand to benefit most.”

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email