Q3 2019 provides interesting reading as the South Coast Industrial Market continues to prove resilient to the wider economic and political uncertainties as stock levels hold steady with development of multi sized estates such as Adanac North, Nursling and the addition of Proxima Park, Waterlooville to the East. We have seen take-up increase against the previous quarter and enquiry levels remain robust during the Summer months.

Availability significantly increases

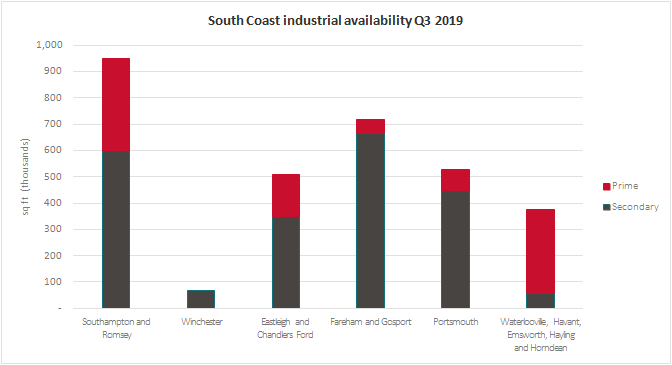

We witnessed a significant increase on total stock of 200,485 sq ft against the previous quarter and even more striking 465,560 sq ft against the same quarter in 2018.

There are new developments out of the ground on both ends of the corridor with three schemes alone providing 226,394 sq ft of prime stock to the market.

At the Eastern end this includes 32,324 sq ft at 5 Interchange Park, Portsmouth and 45,000 sq ft at 310 Proxima Park, Waterlooville. On the Western end Oceanic Estates began construction on Adanac North, Nursling providing 149,070 sq ft of high quality light industrial space, with sizes ranging from 3,434 sq ft to 23,186 sq ft.

In part to the availability of good quality prime stock, Q3 saw numerous secondary buildings come to the market including 71,660 sq ft across two buildings of Units 2200 and 2100 Midpoint 27, Fareham and 56,989 sq ft across two buildings of Units 310 and 610 Fareham Reach, Gosport.

The vital statistics have been summarised below:

|

|

Q3 2019 (sq ft) |

Q2 2019 (sq ft) |

% change |

% change Year on Year |

|

Total stock |

3,141,834 |

2,941,349 |

6.82 |

17.40 |

|

Prime stock |

955,275 |

883,284 |

8.15 |

-15.78 |

|

Secondary stock |

2,186,559 |

2,058,065 |

6.24 |

17.40 |

Take up strong

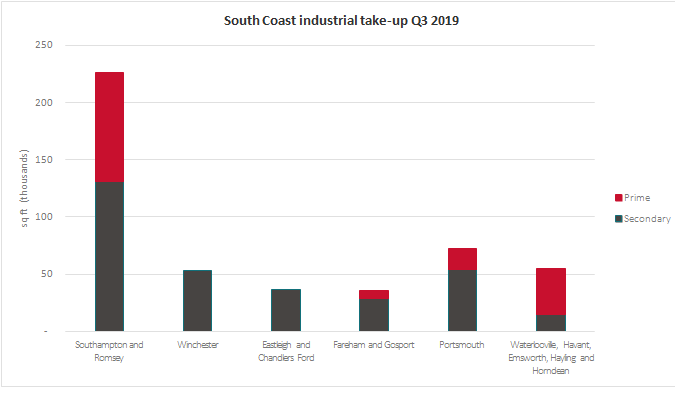

Take up was strong in Q3, increasing on the previous quarter, albeit down slightly on the same period in 2018.

Both prime and secondary take up increased against the previous quarter, highlighting the resilience of the South Coast Industrial Market, and whilst take up of secondary stock was down on last year, prime was up significantly, representing a shift in the dynamics where occupier demand has shifted to the prime stock.

Total take up for Q3 is higher than both previous quarters of 2019 and interestingly puts the quarter above the average of the last four years. Should this continue into Q4 we are likely to forecast total take up for 2019 at a similar if not slightly higher level than 2018.

There are significant transactions to report across the corridor for Q3 including Mountpark’s letting to DSV Air & Sea Ltd of 95,100 sq ft at a rent of £10.25 psf, which leaves a single unit of 74,390 sq ft available, following its two phase development. Portsmouth and Havant saw two strong lettings with the letting of 37,800 sq ft to DPD Group, contributing to the success of the Dunsbury Park scheme, following lettings to Fat Face and VW Breeze. Canmoor Developments achieved further success at Merlin Park, Portsmouth now over 60% let, with the letting to Zidac Laboratories Ltd of 15,179 sq ft on a 15 year lease at circa £10.00 psf, leaving 3 units available of 8036, 9855 and 16 855 sq ft in the 7 unit scheme.

The vital statistics have been summarised below:

|

|

Q3 2019 (sq ft) |

Q2 2019 (sq ft) |

% change |

% change Year on Year |

|

Total take up |

477,967 |

425,464 |

12.34 |

-4.61 |

|

Prime take up |

159,633 |

138,520 |

15.24 |

40.26 |

|

Secondary take up |

318,334 |

286,944 |

10.94 |

-17.80 |

Enquiries down

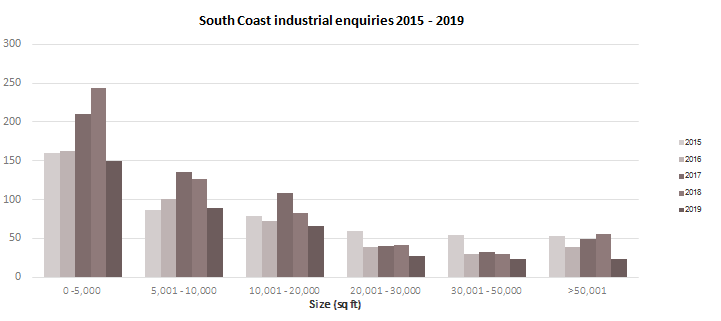

Whilst we report good take up levels, interestingly enquiries are down for Q3, by 12.5% and 20% year on year. We attribute this to market uncertainty for the reduction in volume with occupiers prepared to satisfy themselves within their current premises.

SME’s were the most inquisitive during Q3 with the sub 5,000 sq ft and 10,001 – 20,000 sq ft sectors above the 4 year average.

On reviewing the significant transactions this Quarter, it is not surprising that the B8 Logistics and Distribution occupiers remain the most active and interestingly as a result of new/larger contract awards as opposed to being lease event driven.

Significant occupational transactions

|

Property |

Size |

Landlord/Vendor |

Tenant |

Terms |

Rent / Price (per sq ft) |

|

Unit 4 Mountpark, Southampton |

95,100 sq ft |

Mountpark |

DSV Air & Sea Limited |

5 year lease |

£10.25 |

|

Unit 3B Dunsbury Park, Waterlooville |

37,800 sq ft |

Portsmouth City Council |

DPD Group UK Ltd |

10 year lease |

£10.00 |

|

Unit 5 Merlin Park, Portsmouth |

15,179 sq ft |

Canmoor Developments Limited |

Zidac Laboratories Ltd |

15 year lease |

£10.00 |

|

Unit B Interchange Point, Winchester |

38,900 sq ft |

LaSalle Investment Management |

Salvation Army |

10 year lease |

£7.25 |

|

Unit 140 Mauretania Road, Nursling |

27,155 sq ft |

Aberdeen Standard Investments |

Specialist Sports Ltd |

10 year lease |

£9.50 |

|

Unit H&J Fort Wallington, Fareham |

20,456 sq ft |

Chancerygate |

Expert Logistics |

5 year lease |

£6.00 |

Investment Market Review

Transactional activity over the course of Q3 remained ‘suspended’ as a result of the ongoing uncertainty created around Brexit. Good quality long-income product does continue to be highly sought after which is in contrast to more “secondary” assets which continue to be viewed with a heightened degree of caution. Q2 secondary yields stood at 5.25% to 5.75% (single-let) and 5.25% to 6.00% (multi-let); over the course of this quarter these have drifted out by 25-50bps. The mismatch between buyers and sellers expectations remains apparent. Prime Yields remain firm at 4.25%

Our headline transaction for this quarter was Legal & Generals disposal of TW Metals, Nursling in August 2019 to CBRE Global Investors for £14.65m reflecting a NIY of 5.21%. The property comprised a 109,743 sq ft unit let to TW Metals Limited for a further 6.40 years.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email