While a promising start to market activity in 2020 was turned upside down by the escalation of the COVID-19 pandemic, office occupiers continue to make long-term commitments in the South East region, according to LSH.

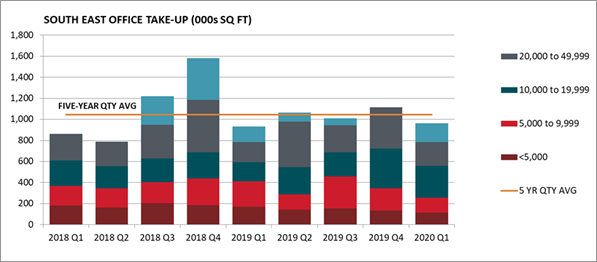

Across the 26 key South East markets, take-up amounted to 962,000 sq ft in Q1 2020, 8% below the five year quarterly average but, notably, 3% above than the same quarter in 2019. Take-up was given an air of respectability by the strong performance of a handful of markets, most notably Hammersmith & Chiswick, Milton Keynes, Woking and Guildford, with 20 of the markets seeing take-up in Q1 fall short of their respective five year trend levels.

Q1’s largest deal by far was in the Hammersmith and Chiswick market, where L’Oreal pre-let 110,000 sq ft at the Gateway Central building, White City. The region’s one other deal in excess of 50,000 sq ft was in Milton Keynes, where Xero agreed to take 55,918 sq ft at the speculatively built 100 Avebury Boulevard, the city’s largest transaction in over five years.

However, the ramping up of measures to contain COVID-19 hampered activity in the latter stages of Q1 and this is expected to lead to a thin quarter of take-up in Q2. LSH’s analysis of its occupier deals pipeline in the region reveals that, after two weeks of the lockdown, 48% of live deals have been paused indefinitely as occupiers focus on business priorities amid the crisis.

That said, notable deals have concluded during the lockdown, affirming occupiers long-term commitment to the region and a faith that normality will return over the coming months. The life sciences sector led by example, with key deals including Eli Lilly agreeing to 42,000 sq ft in Bracknell, Amgen taking 35,000 sq ft at Cambridge Science Park and Daiichi Sankyo’s 10,800 sq ft acquisition at Uxbridge Business Park.

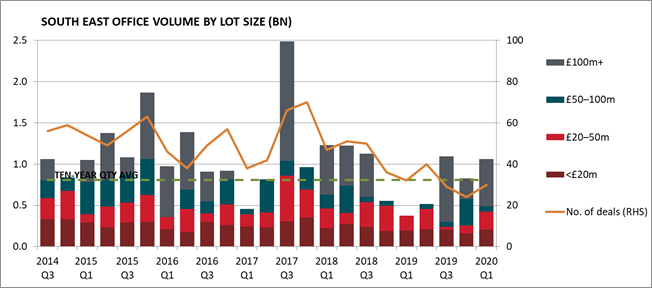

In the investment market, strong volume in Q1 belied the unravelling of the crisis at the end of the quarter. Total volume amounted to £1.06bn in Q1, a threefold increase on the same quarter in 2019 and 31% above the long-term quarterly average.

Investor sentiment was initially positive at the beginning of the year, reflecting the clear cut election outcome and more certainty over the direction of travel with regard to Brexit. Of Q1’s 25 deals, three were in excess of £100m. These comprised Stanhope’s £312m purchase of Building 7 Chiswick Park (NIY 5.50%), Fraser’s Property Holdings’ £135m purchase of 9-11 New Square, Bedfont Lakes, Heathrow and CapitaLand’s £129m purchase of Arlington Business Park, Theale.

While the escalation of the crisis in the latter part of Q1 has put many investors onto the back foot, the market has not shut down completely. Of the 26 assets under offer in mid-March, only six have since been shelved, with the due diligence progressing on the majority. The second week of the lockdown also saw Brookfield Asset Management forge ahead with its £220m acquisition of a 50% stake in the Harwell Campus, Oxfordshire.

Kevin Wood, Head of South East office advisory, commented

“The unprecedented situation we all find ourselves in has, understandably, put a temporary pause on occupier demand. While we are braced for negligible activity in Q2, pending deals will be pushed out to the latter part of the year once a sense of normality returns, which should lead to very strong take-up.

“Ultimately, the supply and demand fundamentals of the South East office market are generally sound, and this should be reflected once the worst of the crisis is over, assuming the impact to businesses is mitigated by government measures.”

Charlie Lake, Director, Offices Capital Markets, commented

“Despite the unprecedented situation, there is as yet limited evidence of a shift in pricing unless there is now a clear risk to income in the short term. Generally, vendors have elected to work with prospective purchasers and take a ‘wait and see’ approach to the wider economic backdrop before aborting deals, and therefore incurring costs, or considering a change in pricing.

“Evidence from China shows us that economic life is rebounding within around three months of the crisis taking hold. As the wider global economy monitors its recovery and the business community continues to adapt to the challenges it faces, the fundamentals in the South East market are underpinning a resilient stance. With new developments and refurbishments also being delayed, the fundamental supply and demand imbalance in the South East will provide investors with confidence to invest in specific markets as opportunities arise.”

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email