Referencing 2020: Approach with Caution

Online plant, machinery & business asset auctions have always had the ability to reach both the national and global markets and is an excellent selling method for optimising the value of assets by attracting end users and dealers alike. They have the added benefit of being totally transparent and demonstrating true market value at any given time

2020, with the uncertainty of Brexit was always going to be a challenging time for all industries. However, the Covid-19 pandemic added further uncertainties, as restrictions on travel & normal working practices were implemented.

Whilst LSH’s robust business continuation plans allowed a seamless transition to home working, and site visits continued where possible, working within government guidelines, the response from the markets’ appetite to continue to invest in used machinery was initially an unknown, and LSH took a cautious approach both in its asset valuation and decision making about the right time to bring assets to market.

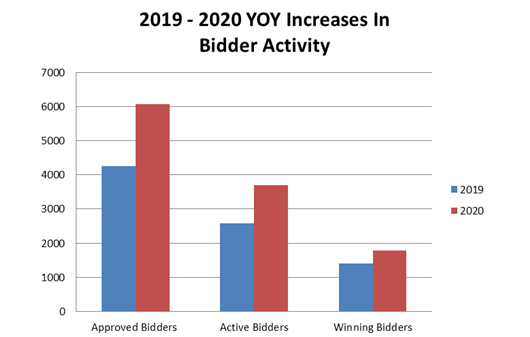

Analysis of our auctions over the last 12 months indicates an increase, not only in buyers in general, but particularly first time auction attendees and the overseas market as demonstrated by the below chart showing YOY increases in bidder registration and activity.

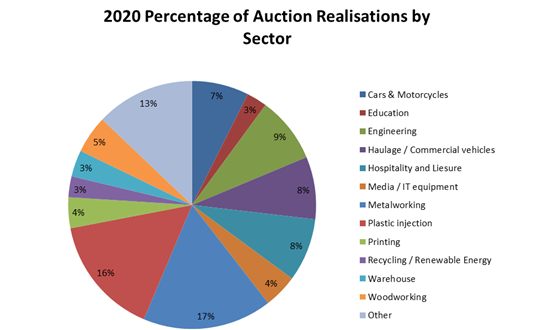

This increase has generally translated into an uplift on anticipated values across certain asset classes and the below chart demonstrates the spread of realisations by asset sector for the sales that we have carried out during this period.

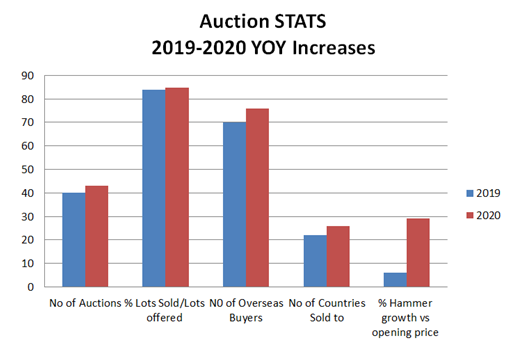

We have also seen modest increases in the percentage of lots sold compared to lots offered, overseas buyers and the demographics of our overseas buyers.

Our auction platform Bidspotter share this view, “demand for insolvency assets has been at an all-time high over the past year, with prices being extremely strong”. Their analysis of the 3 month period for the “hammer growth vs opening price increase”, for the month period from July to September 2020 compared to 2019 , was up 56% YOY.

We were concerned that we may see an increase in buyers defaulting on their purchases, due to travel restrictions, the need to self-isolate, or companies experiencing cash flow problems, however, both the number of defaulters in 2020 and the value of defaults decreased by 13% and 35% respectively YOY and where we did experience genuine problems from bidders we worked with them to find solutions where possible.

As mentioned above, the vast majority of asset sectors have sold surprisingly well at auction, however, there have been some casualties. The travel industry is one of those sectors worst hit due to Covid-19, with the coach operator industry being significantly affected. . Resale prices for coaches have plummeted during this Covid-19 period to unprecedented levels due to the vast surplus of stock on the market at present. This particular market is very volatile at present and care needs to be taken when undertaking valuation and sales instructions.

Auctions of note

Hospitality & Leisure

Unsurprisingly the Hospitality and Leisure sector, particular weddings and large gatherings has been hit hard in 2020. LSH were instructed on two Marquee Hire companies quite early during the pandemic and our challenge was to find a market for assets that seemingly had no imminent value to similar companies. However, realising other areas of this industry needed to move trading to outdoor space we marketed accordingly, resulting in an uplift of “starting price vs. hammer price” by an average of 230%.

Garages & Vehicle Sales

Another industry hit early on were garages and vehicle sales. LSH were instructed on several disposals in this category and the assets available included cars, motorcycles and garage equipment and once again saw an uplift of starting price vs. hammer price by an average of 128%. We also experienced very high attendance and bidding activity in all of our auctions in this sector, and a very high level of first time auction bidders.

Something not affected by Covid!

We were also instructed on some major disposal projects that were not necessarily impacted by the Covid Pandemic. Three instructions this year utilised our extensive in-house H&S expertise and our ability to manage site clearances under The Construction (Design and Management) Regulations 2015 carrying out both Principal Contractor and Principal Designer roles. The result was the safe undertaking of asset sales, and significant cost savings to our client compared to having to outsource these roles. These instructions were across different industrial sectors including metal working, plastic injection and renewable energy.

Printing Companies

With the changes to digital printing, the effects of Brexit and the uncertainty surrounding the COVID-19 outbreak, there have been quite a few print companies having to close their doors, resulting in high value assets coming to the resale market. The majority of the higher value items, such as lithographic print presses and the like, do tend to sale by private treaty, however a large majority of print assets best realise by auction to end users and dealers, with overseas sales to Europe, Africa and Asia.

Exports

The next challenge is the impact of post Brexit export and customs rules. Early indications are that the last minute Brexit deal has found the UK export market unprepared for the new customs requirements causing delays at the borders.

The way LSH manage exports, puts the responsibility for arranging the export and customs paperwork on the buyer and also removes us from being governed by the new complex business to customer rules. However, the rules on claiming preferential rates of duty now mean that only goods proved to have been manufactured in the UK will be exempt from import duties into the EU which may make the market for used plant and machinery originally manufactured in the EU less desirable to the EU market.

At present it is too early to assess any impact on asset realisations and therefore we will be monitoring future sales closely, however one of our current live sales has numerous registrations from the European Market.

After this lockdown...

Going forward, post present lock down, we are expecting an increase in the level of auctions and we have 2 auctions closing this month.

Avara Avlon Pharma Services site with over 800 lots of engineering, laboratory, workshop, factory and catering equipment, IT, office furniture etc.

Click here for further details

High Volume Distribution Centre - Phase 2, currently being catalogued which will include.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email