The ongoing decimation of the hospitality and leisure industries has been one of the clear impacts of the COVID – 19 pandemic, with barely a day going by without news of a new insolvency in the sector.

Within the hospitality sector casual dining has been severely affected. Initially this was due to the nationwide lockdown, which resulted in a number of high profile chain collapses or CVAs, through a period of recovery boosted by the government’s ‘Eat Out to Help Out’ scheme, and then restaurants and pubs offering restricted trading, or even facing closure again due to the 2nd wave impact of Covid and the new tiering systems introduced. At the time of going to press we are now in the position of a 2nd nationwide lockdown for at least 4 weeks in England when only take-away services can be offered, with various other restrictions in Wales, Scotland and Northern Ireland. Additionally consumers have changed their habits, in part due to uncertainty on disposable income and future earnings, but also as they have got used to the take-away/delivery culture during periods when visits to restaurants were not possible.

Over the last 6 months our National Machinery & Business Assets Team, often working alongside sector specialists within LSH, has been engaged in a large number of related insolvency cases. These have included national dining chains, such as Carluccios and Chiquito, Burger King and Pizza Hut franchises, as well as smaller local operations. We have also dealt with businesses in the events industry, a sector which has also been severely impacted and continues to see no visibility on when trade will return to anything resembling that prior to the pandemic.

It is interesting to note that analysis by PricewaterhouseCoopers details that in the 12 months to the end of September 2020 there were 1,464 company failures in the sector against 1,304 in the same period in the previous 12 months. Hospitality and leisure insolvencies however were down by 15% in the third quarter compared to the previous three months, and were down by 11% compared to the same quarter last year. Unsurprisingly restaurants were the worst hit with 156 insolvencies across the UK in Q3, and the biggest drops in insolvencies between Q2 and Q3 were hotels which saw a 43% fall and travel and tourism which dropped by 40%.

On a more positive note, the pandemic has resulted in the UK’s ‘staycation’ boom. The hotel sector has been hit hard, with most hotels shut from late March for over three months, and many re-opening on 4th July. Since then there have been wide variations in the performance of markets across the country. The main bright spot for the sector has been the strength of the staycation market, which has led the recovery. This has been driven by holidaymakers booking UK breaks due to restrictions and uncertainty around overseas travel, with internet searches related to staycations reaching record highs, and Cumberland Building Society reporting that 83% of respondents to their survey preferred to take holidays in the UK rather than travel abroad this year.

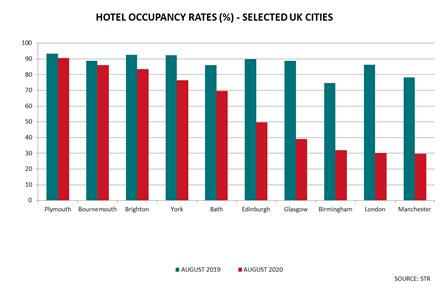

The focus on staycations led to a remarkable divergence in the performance of UK hotel markets over the summer, with key tourist locations and in particular coastal areas in the south experiencing a significant bounce in occupancy rates; Plymouth, Bournemouth and Brighton recorded occupancy levels above 80% in August, close to those of 2019, according to STR data.

Conversely, occupancy rates remained low in many of the UK’s largest cities, with these markets reliant upon international and business travel. Local lockdowns in areas such as Greater Manchester and the West Midlands have also impacted occupancy, with levels in London, Manchester and Birmingham around just 30% in August. The decline in the fortunes of the London market is particularly dramatic, given that the city consistently commands the highest room rates in the UK and occupancy rates are usually well over 80%.

It is likely that turbulence in the hospitality and leisure sectors will continue, at least until a COVID-19 vaccine is widely available. As in all markets there will be winners and losers. Demand for staycations, for instance, is expected to be strong into next summer, which in turn should give a boost to the hospitality sector but this will of course depend upon management of the virus.

If you would like advice on this sector or any business type please do contact either myself or one of your local regional team.

Best wishes,

Alan Austin

National Head of Machinery and Business Assets

| Our Track Record | |

|

|

| Food & Fuel Limited

We commenced marketing this chain of 11 well known London gastropubs soon after lockdown and successfully transacted a number of fully fitted leasehold units through the lockdown period at significant lease premiums. |

The Atlantic Hotel

We undertook took a wide marketing campaign of this trading hotel on behalf of the Administrators resulting in competitive bidding and a successful sale. |

|

|

| Shepherds Cox Hotels

Our specialist hotel agency team have recently marketed three hotels in North Allerton, Durham and Halifax on behalf of the Administrators which resulted in strong competitive bidding and all units are currently under offer. |

Beautiful World of Tents

Demand of the event equipment including tipi tents was considerable, with our online auction attracting in excess of 325 buyers and a total hammer price of £225,000. |

|

|

| Natural Kitchens

On behalf of the Administrators we marketed the IPR and physical assets of a restaurant, bar and delicatessen chain with 9 Central London units, and successfully concluded a sale of the non-property assets, with the purchaser seeking to negotiate improved lease terms with landlords. |

Restaurant Furniture and Kitchen Equipment Sales

Do not assume that values for such second hand items are at rock bottom. Having undertaken numerous sales by online auction and private treaty, we know there is still strong demand for good quality well maintained equipment from both end users and dealers. While values have dipped marginally, at the current time they are holding up surprisingly well. |

|

|

| Bredbury Hall Hotel & Country Club

Our specialist hotel agency team are currently marketing this well established hotel and country club in the north west on behalf of Administrators, seeking offers in the region of £5,250,000. Further information can be found at https://bit.ly/3e5ezhm |

STA travel Acting for the Liquidators we have secured and disposed of the nationwide company assets and undertaken a marketing campaign of the leasehold property portfolio. |

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email